How we compare

- Banks

- Hard Money

lenders - Best customer service First Continental

- Slow decision makers, typically 2-3 months.

- Unreliable sources of funds.

-

Indicative decision within just 15 minutes – close in as little as 30 days.

- Generalist knowledge. High staff turnover.

- Generalist knowledge. Lender here one day, gone the next.

-

Expert team of long tenured, residential development specialists.

- Commercial interest rates.

- High interest rates and fees.

-

Straightforward rate structure, best risk adjusted cost of capital.

- Personal guarantees typically required. Your personal assets at risk if you default.

- Guarantees often required. Expensive pre-payment penalties and gotcha clauses.

-

No personal liability. Your personal assets NOT at risk (non-recourse).

- Inflexible and unable to adapt quickly when times get tough.

- Will foreclose quickly when times get tough.

-

We work with you to bring flexibility and solutions whenever needed.

Why We’re Different from Banks & Hard Money Lenders

Most regulated financial institutions, such as banks, have a difficult time providing quick responses and delivering the flexibility needed for residential development financing and developed lot loans.

First Continental, on the other hand, offers quick decisions from loan application to loan closing, and all throughout the construction and sell out process. Decisions are made timely by a small group of expert professionals in Houston, TX.

Fast

Decision Making

Conversely, banks are often held hostage by layers of loan committees, out of town decision makers and regulatory limitations. The banking system has been difficult to count on during slow housing markets, with most banks abandoning the land acquisition and development loan business following the last recession.

First Continental has been a consistent, reliable provider of residential lot financing not only through peak economic times, but also throughout the entirety of the Great Recession.

outstanding customer service

BORROWER PROFILE

Our borrowers are typically single-asset, single-purpose entities with experienced operators that have successful track records.

Lending criteria

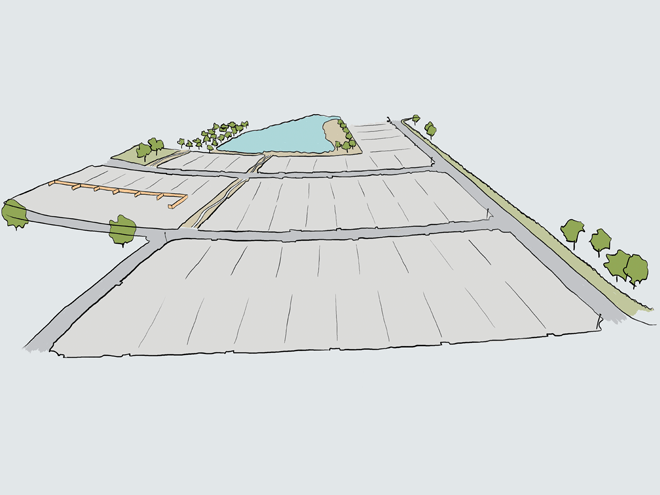

We focus on entry-level to second-time move-up price points in metropolitan areas that have positive financial trends and available economic and housing data.

Prospective projects are preferably permitted and “shovel ready”, presold to production homebuilders in "for sale" communities where committed phasing can be completed and sold within 3 years.

The loan-to-cost/loan-to-value requirements are predominantly in the 60% to 75% range depending on the size & development characteristics of the project.

Our typical loan range is $1m-$12m. However, we do not focus on minimums or maximums but rather identifying high-quality operators for development of long-term relationships.